Bearish Chart Patterns

Bearish Chart Patterns - Check out or cheat sheet below and feel free to use it for your training! Web chart patterns are unique formations within a price chart used by technical analysts in stock trading (as well as stock indices, commodities, and cryptocurrency trading ). Whether it’s a road, a door, or a new machine, putting up a sign helps us understand what to do next. When the pattern occurs in more extended time frames, such as daily and weekly, it tends to affirm the prospect of price reversing from an uptrend to a downtrend. The former starts when the sellers push the price action lower to create a series of the lower highs and lower lows. Web the s&p 500 gapped lower on wednesday and ended the session at lows, forming what many candlestick enthusiasts would refer to as an ‘evening star candlestick pattern’. We see the inverted head and shoulder patterns in major downtrends. Web for example, chart patterns can be bullish or bearish or indicate a trend reversal, continuation, or ranging mode. It’s formed by connecting higher highs and even higher lows, converging to a point termed the apex. These patterns are characterized by a series of price movements that signal a bearish sentiment among traders. It suggests a potential reversal in the trend. Web bearish candlestick patterns typically tell us an exhaustion story — where bulls are giving up and bears are taking over. Hanging man is a bearish reversal candlestick pattern having a long lower shadow with a small real body. Web bearish chart patterns are formed when stock prices start to decline after a period of bullish movement. Web the rising wedge is a bearish chart pattern found at the end of an upward trend in financial markets. Channel resistance (taken from the high of 5,325) and a 1.272% fibonacci. One side is always going to win. The first indication of an island top is a significant gap up, or sharply higher price at the open, following an upward price trend. Web a bearish candlestick pattern is a visual representation of price movement on a trading chart that suggests a potential downward trend or price decline in an asset. Many of these are reversal patterns. But the good news is that we can review the lessons of market history and notice what consistent patterns have occurred at previous market topics. The markets are a tug of war between the bulls and the bears when stock trading. Web bearish candlesticks are one of two different candlesticks that form on stock charts: Japanese candlestick charting techniques are. Web the s&p 500 gapped lower on wednesday and ended the session at lows, forming what many candlestick enthusiasts would refer to as an ‘evening star candlestick pattern’. It’s formed by connecting higher highs and even higher lows, converging to a point termed the apex. Web for example, chart patterns can be bullish or bearish or indicate a trend reversal,. Web bearish candlestick patterns typically tell us an exhaustion story — where bulls are giving up and bears are taking over. Web 📍 bearish reversal candlestick patterns : It’s formed by connecting higher highs and even higher lows, converging to a point termed the apex. The psychological $2.00 level may provide initial support, with further. At the same time, the. Web in technical analysis, the bearish engulfing pattern is a chart pattern that can signal a reversal in an upward price trend. Web chart patterns are unique formations within a price chart used by technical analysts in stock trading (as well as stock indices, commodities, and cryptocurrency trading ). They signify the market sentiment is changing from positive to negative. It’s formed by connecting higher highs and even higher lows, converging to a point termed the apex. In a bearish pattern, volume is falling, and a flagpole forms on the right side of the pennant. A strong downtrend, and a period of consolidation that follows the downtrend. Bar charts and line charts have become antiquated. Hanging man is a bearish. The patterns are identified using a series of trendlines or curves. This is a bearish reversal signal and was established a whisker south of resistance: Whether it’s a road, a door, or a new machine, putting up a sign helps us understand what to do next. They provide technical traders with valuable insights into market psychology and supply/demand dynamics. Web. Web for example, chart patterns can be bullish or bearish or indicate a trend reversal, continuation, or ranging mode. Web bearish chart patterns are formed when stock prices start to decline after a period of bullish movement. One side is always going to win. The patterns are identified using a series of trendlines or curves. If spotted, they’re moneymakers as. Candlesticks have become a much easier way to read price action, and the patterns they form tell a very powerful story when trading. As i was often reminded in my early days in the industry. It is one of the shortest bear patterns, generally taking just three to five days to form. Web in trading, a bearish pattern is a. They signify the market sentiment is changing from positive to negative and often indicate a possible downtrend. This pattern suggests a potential reversal of an uptrend, indicating that the price might break to the downside once the pattern concludes. Some days, the bulls win. One side is always going to win. Japanese candlestick charting techniques are the absolute foundation of. We see the inverted head and shoulder patterns in major downtrends. As i was often reminded in my early days in the industry. Many of these are reversal patterns. Japanese candlestick charting techniques are the absolute foundation of. Web along with the potential double top on the rsi indicator from the overbought zone, the chart reversed with a bearish engulfing. Web 5 powerful bearish candlestick patterns. One side is always going to win. If spotted, they’re moneymakers as the head and shoulders top used. Web a bearish pennant is a pattern that indicates a downward trend in prices. These patterns are characterized by a series of price movements that signal. We see the inverted head and shoulder patterns in major downtrends. At the same time, the pair has formed a rising wedge chart pattern that i. Bar charts and line charts have become antiquated. In a bearish pattern, volume is falling, and a flagpole forms on the right side of the pennant. Web chart patterns refer to recognizable formations that emerge from security price data over time. It’s formed by connecting higher highs and even higher lows, converging to a point termed the apex. The actual reversal indicates that selling pressure overwhelmed buying pressure for one or more days, but it remains unclear whether or not sustained selling or lack of buyers will. Web in trading, a bearish pattern is a technical chart pattern that indicates a potential trend reversal from an uptrend to a downtrend. The first indication of an island top is a significant gap up, or sharply higher price at the open, following an upward price trend. Hanging man is a bearish reversal candlestick pattern having a long lower shadow with a small real body. It is the opposite of the bullish falling wedge pattern that occurs at the end of a downtrend.Bearish Reversal Candlestick Patterns The Forex Geek

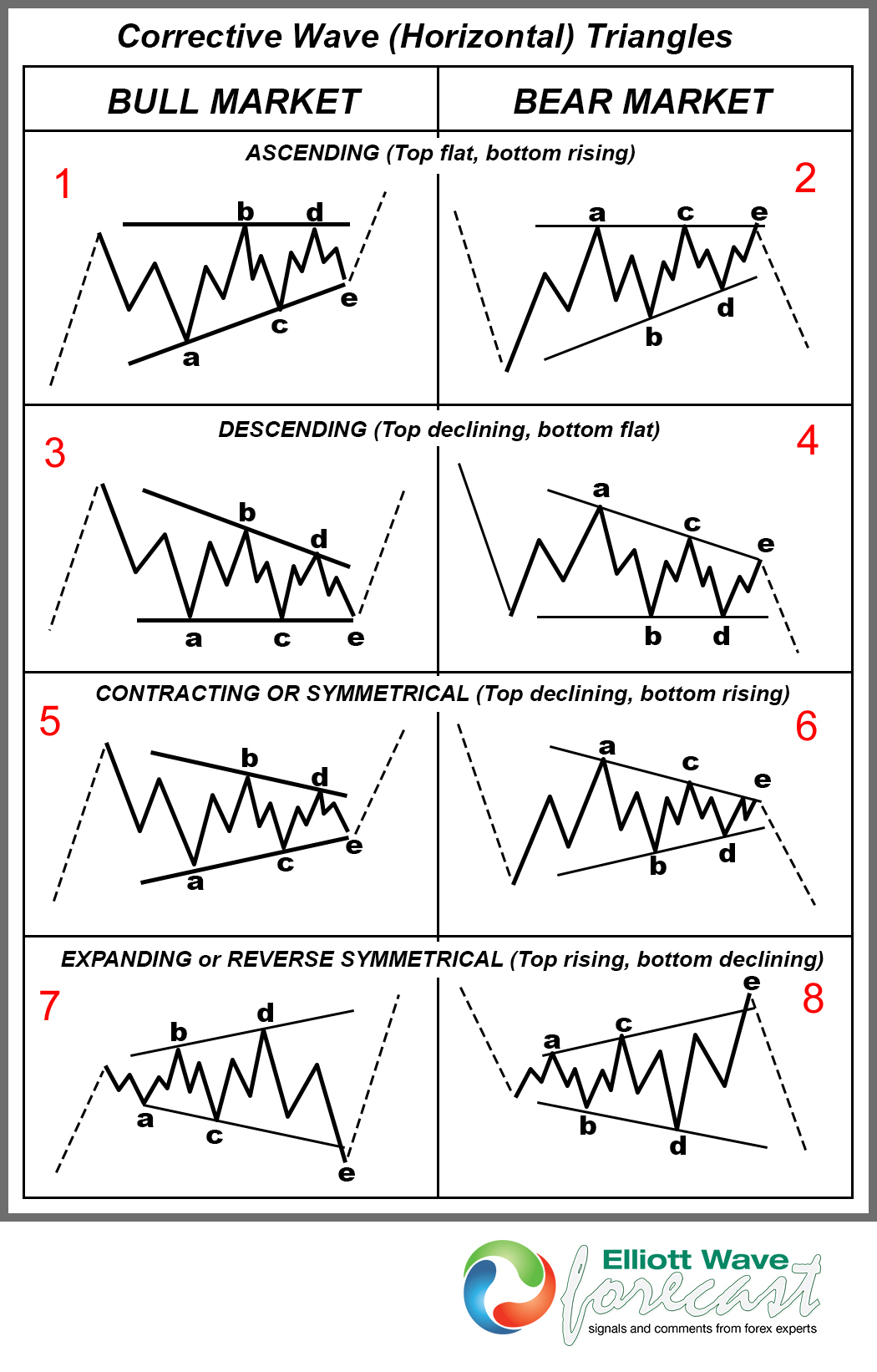

Types Of Triangle Chart Patterns Design Talk

Candlestick Patterns Cheat Sheet Bruin Blog

bearishreversalcandlestickpatternsforexsignals Candlestick

Mastering Trading Our Ultimate Chart Patterns Cheat Sheet

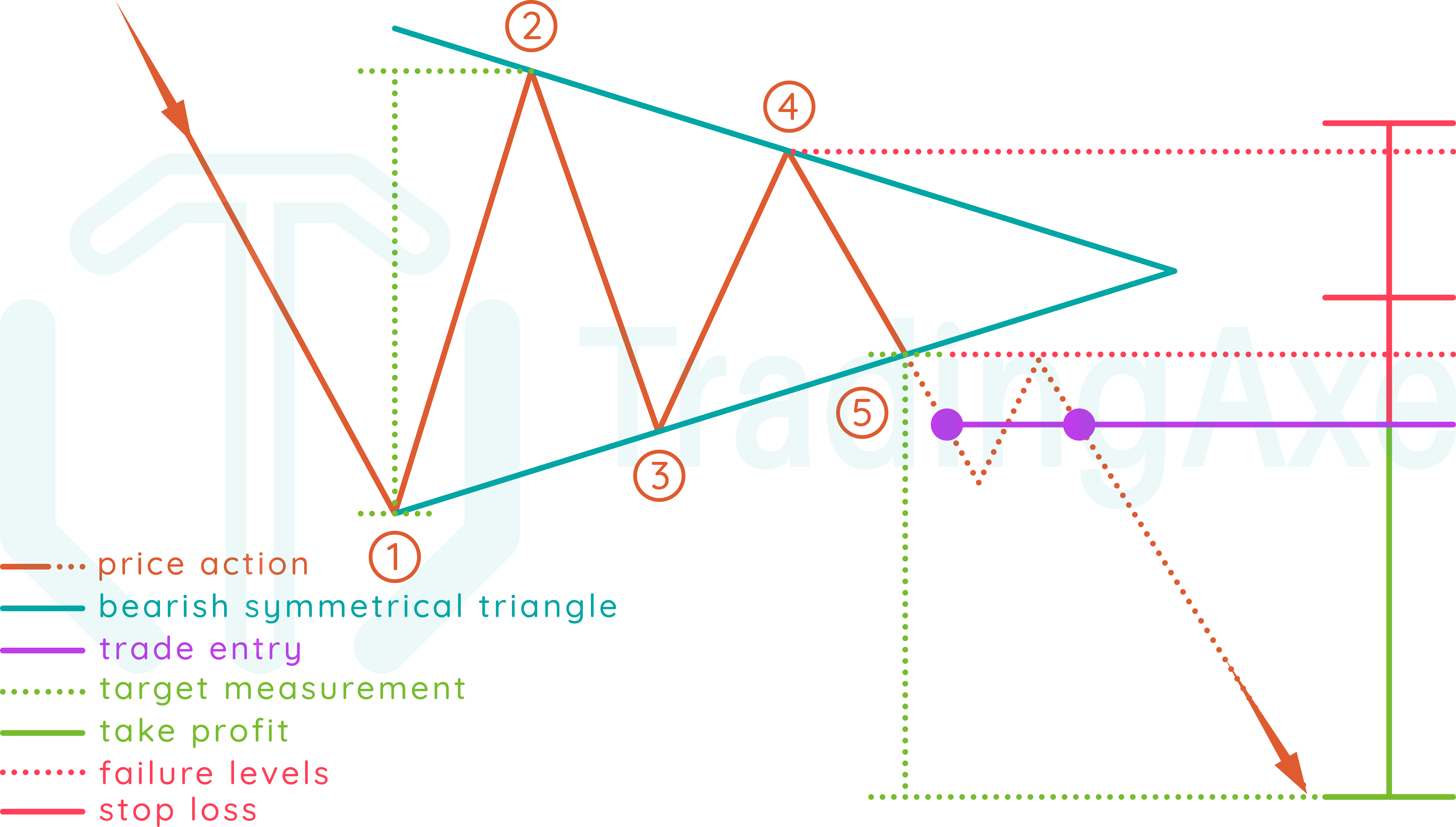

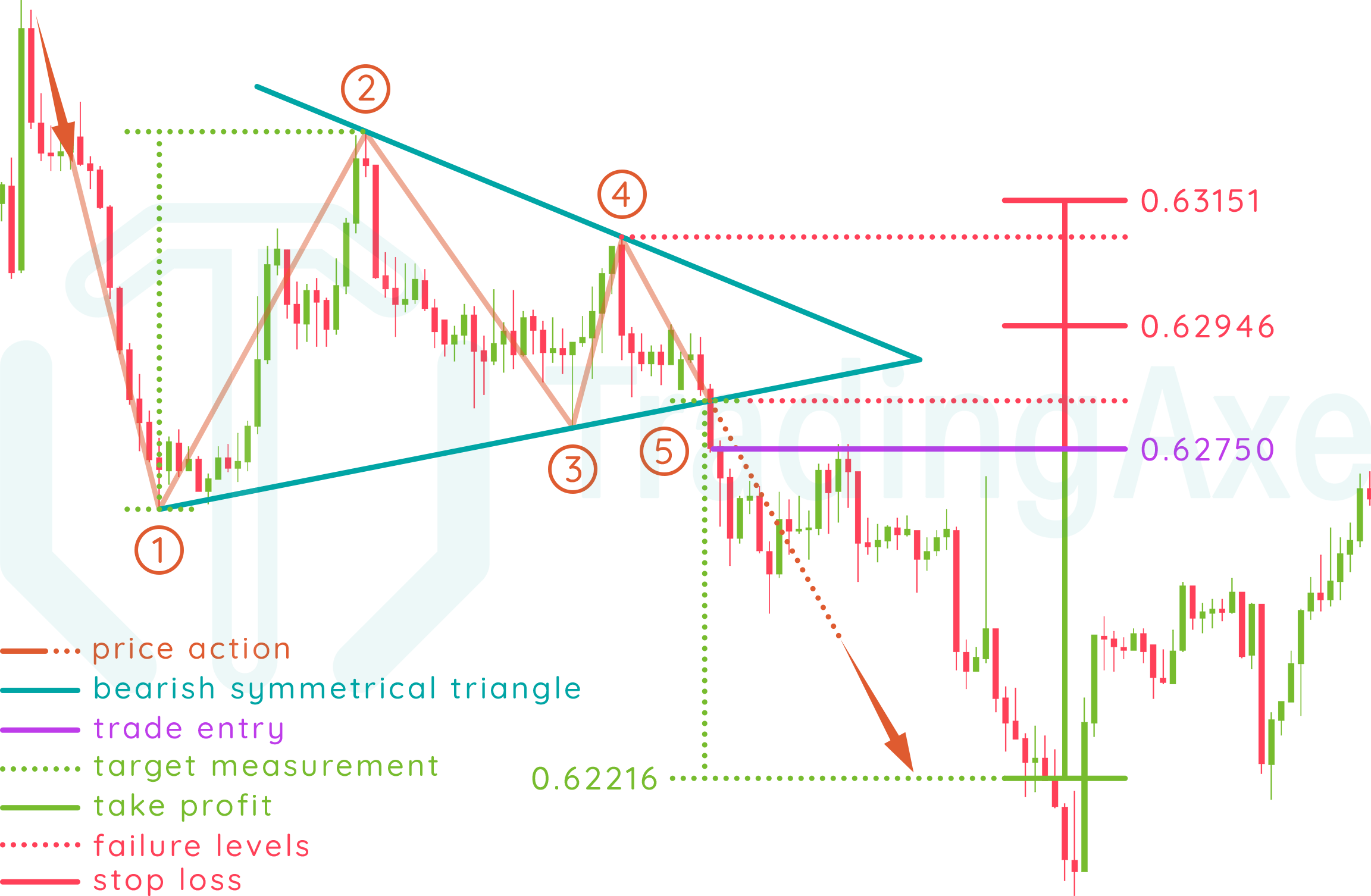

How To Trade Bearish Symmetrical Triangle Chart Pattern TradingAxe

Bearish Candlestick Patterns Blogs By CA Rachana Ranade

Bearish Candlestick Reversal Patterns Stock trading strategies

How To Trade Bearish Symmetrical Triangle Chart Pattern TradingAxe

Bullish And Bearish Chart Patterns

Web The S&P 500 Gapped Lower On Wednesday And Ended The Session At Lows, Forming What Many Candlestick Enthusiasts Would Refer To As An ‘Evening Star Candlestick Pattern’.

The Rising Wedge, Although Appearing To Slope Upwards, Is Predominantly A Bearish Pattern.

Japanese Candlestick Charting Techniques Are The Absolute Foundation Of.

The Patterns Are Identified Using A Series Of Trendlines Or Curves.

Related Post:

.png)