Hanging Man Candlestick Chart

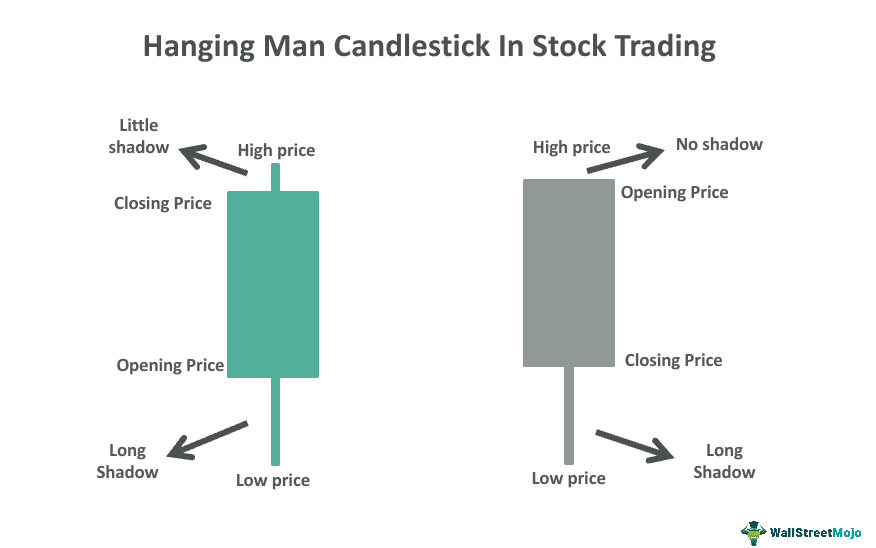

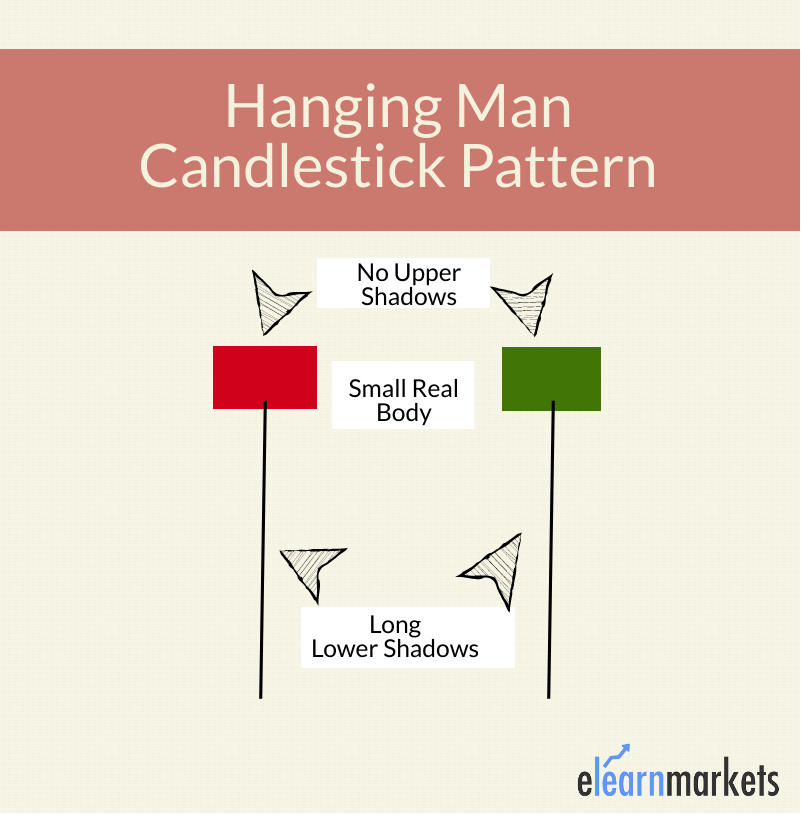

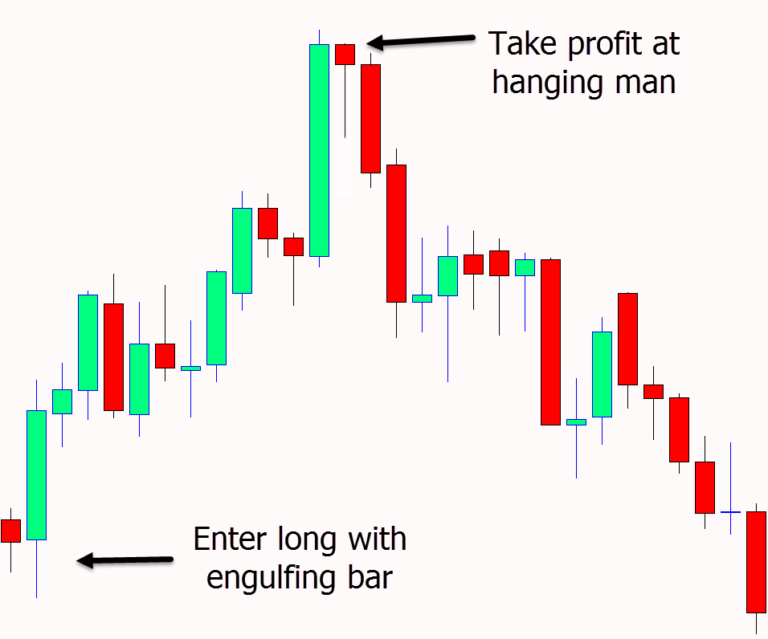

Hanging Man Candlestick Chart - All one needs to do is find a market entry point, set a stop loss, and locate a profit target. It forms at the top of an uptrend and has a small real body, a long lower shadow, and little to no upper shadow. Strategies to trade the hanging man candlestick pattern. Identify the long term trend. It’s recognized for indicating a potential reversal in a bullish market, suggesting that the ongoing uptrend might be weakening. Web this article describes the hanging man candlestick, including performance statistics and rankings, written by internationally known author and trader thomas bulkowski. That day the stock opened and closed at practically the same price and formed a hanging man candle. This pattern provides an opportunity for traders to squar their buy position and enter a short position. An umbrella line is a long candlestick with a short real body located at the top end of the trading range, a long lower shadow, and very little or. The hanging man is a single candlestick pattern that appears after an uptrend. How to identify the hanging man candlestick pattern. Web the hanging man candlestick pattern is characterized by a short wick (or no wick) on top of small body (the candlestick), with a long shadow underneath. The hanging man is a single candlestick pattern that appears after an uptrend. Hanging man candlesticks form when the end of an uptrend is occurring. Sellers were able to drive prices lower intraday but lacked the momentum to sustain the down move. Web a hanging man candlestick is a technical analysis bearish reversal pattern that indicates a potential trend reversal from an uptrend to a downtrend. Web the candlestick charts visually depict emotions wherein the candle’s size and color signify the price moves and the magnitude of the price movements. Web the hanging man forex pattern is a singular candlestick pattern like the doji or hammer forex patterns, for example. This pattern provides an opportunity for traders to squar their buy position and enter a short position. The first line of the bearish harami pattern being a long white candle seems to be a bullish signal. The bearish candlestick hammer, also known as the hanging man pattern, occurs when the opening price is higher than the closing price, creating a red candle. Web like the hammer pattern, the hanging man pattern consists of a single candlestick that is called an umbrella line. Web the hanging man pattern is a single candle formation that is easily recognizable. There is no upper shadow and lower shadow is twice the length of its body. Web the hanging man candlestick pattern is characterized by a short wick (or no wick) on top of small body (the candlestick), with a long shadow underneath. Price reversals are some of the most traded setups in the financial markets. The hanging man is a. View the chart on a longer time frame (perhaps a daily chart) to get an idea of the direction the market is heading. Web this candlestick chart pattern has a small real body, which means that the distance between the opening and closing price is very small. Price reversals are some of the most traded setups in the financial markets.. View the chart on a longer time frame (perhaps a daily chart) to get an idea of the direction the market is heading. Identify the long term trend. If the candlestick is green or white,. It signals a weak bull and strong bear presence in the market at the far end of an uptrend. Web this article describes the hanging. Web this article describes the hanging man candlestick, including performance statistics and rankings, written by internationally known author and trader thomas bulkowski. This pattern provides an opportunity for traders to squar their buy position and enter a short position. View the chart on a longer time frame (perhaps a daily chart) to get an idea of the direction the market. Web a hanging man candlestick is typically found at the peak of an uptrend or near resistance levels. Variants of the hanging man candlestick pattern. The candle is formed by a long lower shadow coupled with a small real. View the chart on a longer time frame (perhaps a daily chart) to get an idea of the direction the market. Web the hanging man forex pattern is a singular candlestick pattern like the doji or hammer forex patterns, for example. It’s recognized for indicating a potential reversal in a bullish market, suggesting that the ongoing uptrend might be weakening. It creates a significant support zone, strengthened by a high trading volume. The first line of the bearish harami pattern being. Web this candlestick chart pattern has a small real body, which means that the distance between the opening and closing price is very small. The first line of the bearish harami pattern being a long white candle seems to be a bullish signal. Web the candlestick charts visually depict emotions wherein the candle’s size and color signify the price moves. An umbrella line is a long candlestick with a short real body located at the top end of the trading range, a long lower shadow, and very little or. Strategies to trade the hanging man candlestick pattern. How to identify the hanging man candlestick pattern. These candlesticks look like hammers and have a smaller real body with a longer lower. Web the hanging man forex pattern is a singular candlestick pattern like the doji or hammer forex patterns, for example. It forms at the top of an uptrend and has a small real body, a long lower shadow, and little to no upper shadow. Web a hanging man candlestick is typically found at the peak of an uptrend or near. Sellers were able to drive prices lower intraday but lacked the momentum to sustain the down move. Anytime a stock has had a significant move either up or. Web a hanging man candlestick is typically found at the peak of an uptrend or near resistance levels. The first line of the bearish harami pattern being a long white candle seems to be a bullish signal. How to trade the hanging man candlestick pattern. Web the hanging man pattern is a single candle formation that is easily recognizable by its distinctive shape. Price reversals are some of the most traded setups in the financial markets. Web the hanging man candlestick has clear visual cues, making it an easy pattern to spot in the charts. These candlesticks look like hammers and have a smaller real body with a longer lower shadow and no upper wick. Web this article describes the hanging man candlestick, including performance statistics and rankings, written by internationally known author and trader thomas bulkowski. Web in essence, the hanging man candlestick chart shows a battle between eager sellers and increasingly weak buyers. An umbrella line is a long candlestick with a short real body located at the top end of the trading range, a long lower shadow, and very little or. Identify the long term trend. There is no upper shadow and lower shadow is twice the length of its body. How to identify the hanging man candlestick pattern. If the candlestick is green or white,.Hanging Man' Candlestick Pattern Explained

Hanging Man Candlestick Pattern Meaning, Explained, Examples

Hanging Man Candlestick Pattern (How to Trade and Examples)

What Is Hanging Man Candlestick Pattern With Examples ELM

How to Use Hanging Man Candlestick Pattern to Trade Trend Reversal

Hanging Man Candlestick Pattern Trading Strategy

How to Use Hanging Man Candlestick Pattern to Trade Trend Reversal

How to Trade the Hanging Man Candlestick ForexBoat Trading Academy

Hanging Man Candlestick Pattern Trading Strategy

Hanging man candlestick chart pattern. Trading signal Japanese

The Candle Is Formed By A Long Lower Shadow Coupled With A Small Real.

They Are Typically Red Or Black On Stock Charts.

Web Candlestick Charts Are One Of The Most Popular Components Of Technical Analysis, Enabling Traders To Interpret Price Information Quickly And From Just A Few Price Bars.

The Hanging Man Is A Single Candlestick Pattern That Appears After An Uptrend.

Related Post:

:max_bytes(150000):strip_icc()/UnderstandingtheHangingManCandlestickPattern1-bcd8e15ed4d2423993f321ee99ec0152.png)