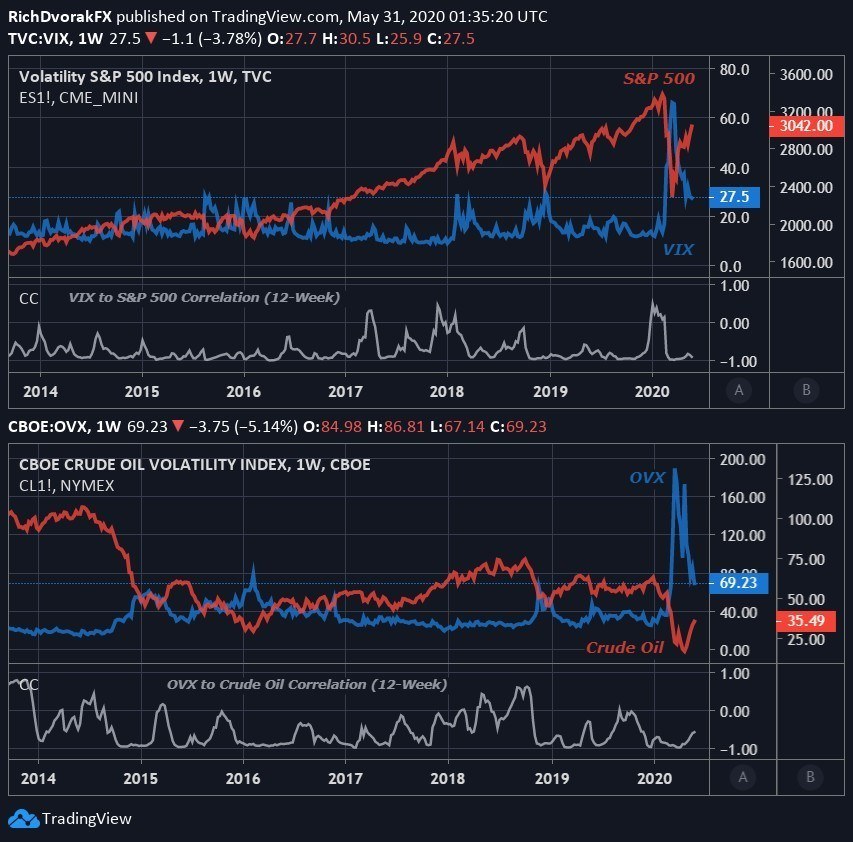

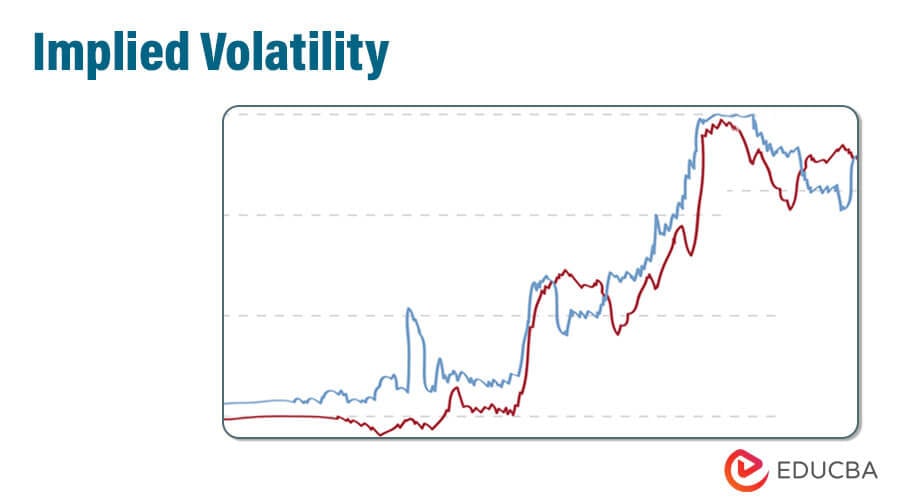

Implied Volatility Chart

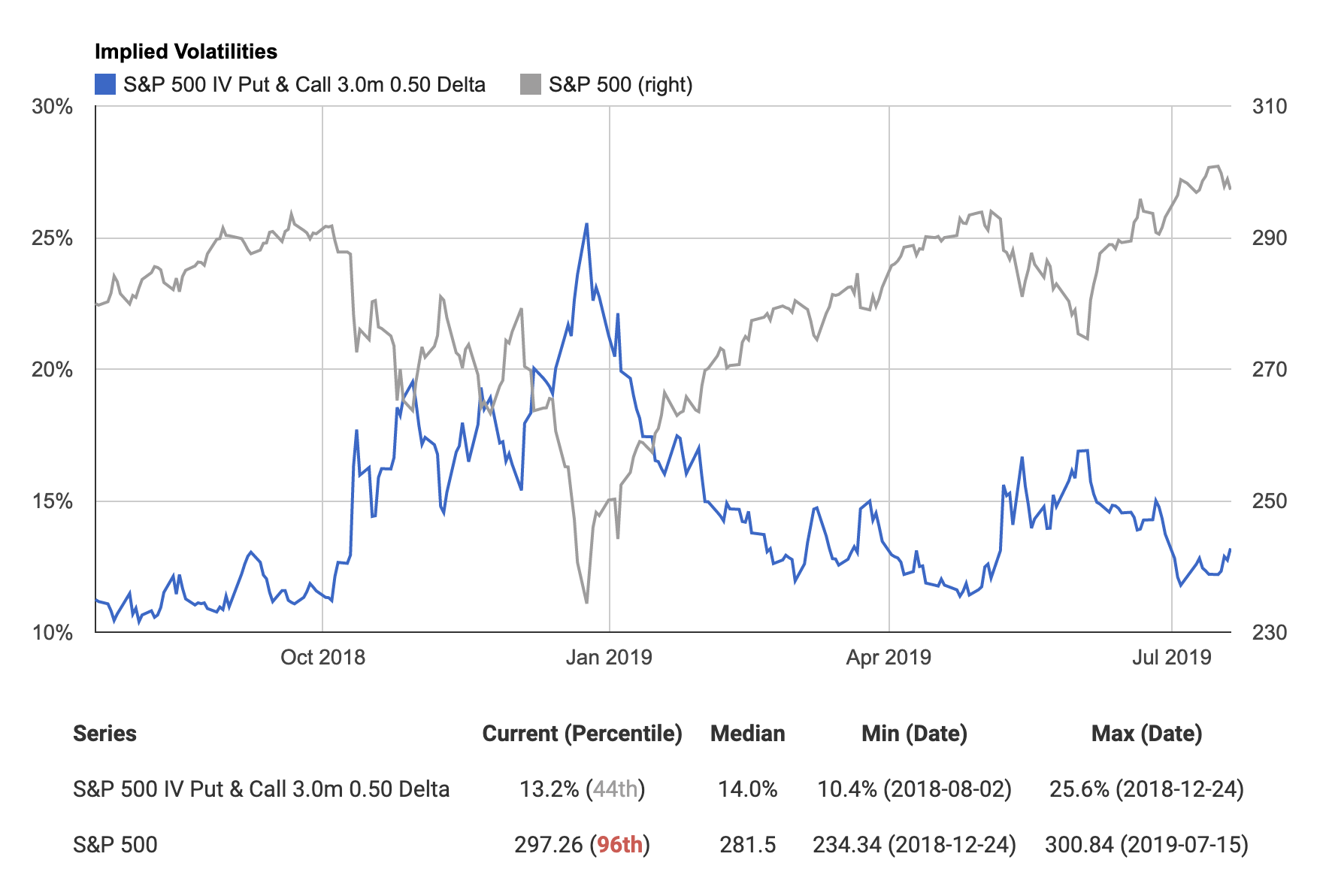

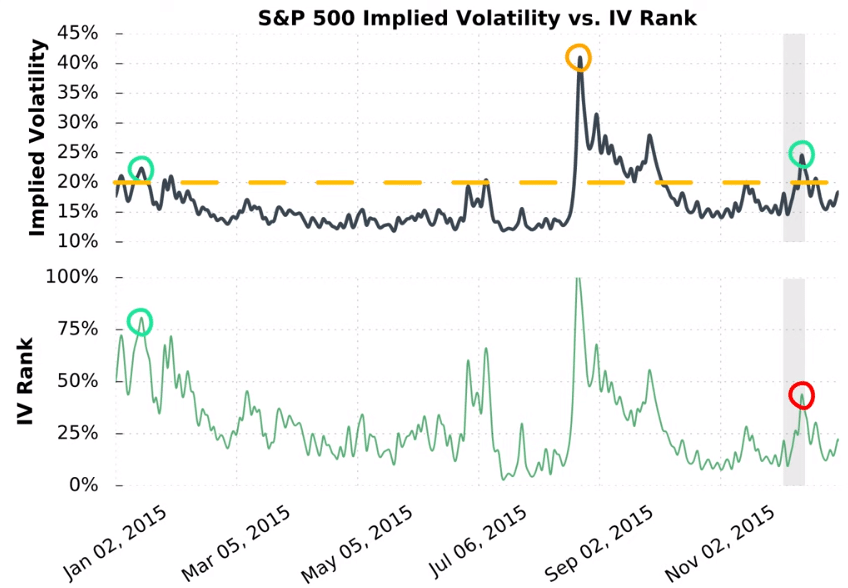

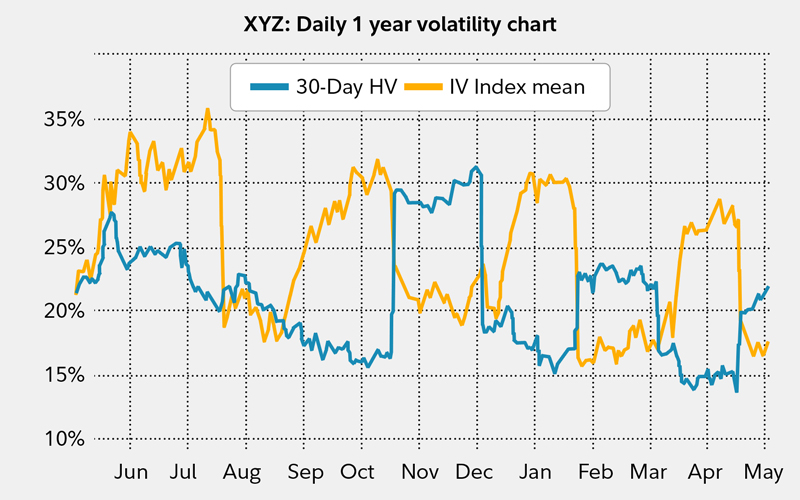

Implied Volatility Chart - Web implied volatility (iv) charts for nifty and banknifty. Web severity of price fluctuation. In other words, an asset's. Web today, several major companies are expected to report earnings: Web the highest implied volatility options page shows equity options that have the highest implied volatility. Our charting tools contain over 10 years of historical data for you to leverage to uncover investment opportunities. See open interest of options and futures, long/short build up, max pain, pcr, iv, ivp and volume over time. Overlay and compare different stocks and volatility metrics using the interactive features. American express ( axp ), comerica ( cma ), euronet worldwide. From the charts tab, enter a symbol. Options with high levels of implied volatility suggest that investors in the underlying stocks are expecting a big. As expectations change, option premiums react appropriately. Web learn the difference between implied and historical volatility and find out how to align your options trading strategy with the right volatility exposure. Implied volatility rises and falls, affecting the value and price of. Abbott laboratories (abt), cintas (ctas), dr horton (dhi), domino’s pizza (dpz), infosys (infy), intuitive surgical (isrg. Previously, these strategies were marketed as defensive equity but more recently have picked up a new marketing spin: Web traders can pull up an implied volatility chart to see iv on different time frames. Our charting tools contain over 10 years of historical data for you to leverage to uncover investment opportunities. Web implied volatility represents the market consensus of what the price volatility of the underlying instrument will be, so it is very important to understand. Web implied volatility (iv) is essentially a measure of how much the market believes the price of a stock or other underlying asset will move in the future, and is a key factor in determining the. A green implied volatility means it is increasing compared to yesterday, and a red implied volatility means it is decreasing compared to yesterday. Overlay and compare different stocks and volatility metrics using the interactive features. Web implied volatility, synonymous with expected volatility, is a variable that shows the degree of movement expected for a given market or security. T oday,. Market volatility is defined as a statistical measure of an asset's deviations from a set benchmark or its own average performance. See open interest of options and futures, long/short build up, max pain, pcr, iv, ivp and volume over time. Web implied volatility represents the expected volatility of a stock over the life of the option. Options with high levels. Implied volatility shows how the. Market volatility is defined as a statistical measure of an asset's deviations from a set benchmark or its own average performance. Implied volatility rises and falls, affecting the value and price of. American express ( axp ), comerica ( cma ), euronet worldwide. Web implied volatility shows how much movement the market is expecting in. Iv can help traders determine if options are fairly valued, undervalued, or overvalued. See open interest of options and futures, long/short build up, max pain, pcr, iv, ivp and volume over time. Our charting tools contain over 10 years of historical data for you to leverage to uncover investment opportunities. Web implied volatility (iv) charts for nifty and banknifty. Web. From the charts tab, enter a symbol. Abbott laboratories (abt), cintas (ctas), dr horton (dhi), domino’s pizza (dpz), infosys (infy), intuitive surgical (isrg. As expectations change, option premiums react appropriately. Get the real time chart and historical implied volatility charts. Web implied volatility is a statistical measure of the expected amount of price movements in a given stock or other. Overlay and compare different stocks and volatility metrics using the interactive features. Web implied volatility, synonymous with expected volatility, is a variable that shows the degree of movement expected for a given market or security. Abbott laboratories (abt), cintas (ctas), dr horton (dhi), domino’s pizza (dpz), infosys (infy), intuitive surgical (isrg. Market volatility is defined as a statistical measure of. Web the highest implied volatility options page shows equity options that have the highest implied volatility. Web severity of price fluctuation. Web implied volatility is a metric used by investors to estimate a security’s price fluctuation (volatility) in the future and it causes option prices to inflate or deflate as demand changes. Our platform allows you to flexibly chart historical. Web implied volatility is a metric used by investors to estimate a security’s price fluctuation (volatility) in the future and it causes option prices to inflate or deflate as demand changes. Implied volatility shows how the. Traders use iv for several reasons. Implied volatility rises and falls, affecting the value and price of. Overlay and compare different stocks and volatility. Web implied volatility (iv) charts for nifty and banknifty. Web view volatility charts for spdr dow jones industrial average etf trust (dia) including implied volatility and realized volatility. Web learn the difference between implied and historical volatility and find out how to align your options trading strategy with the right volatility exposure. Web view volatility charts for apple (aapl) including. Implied volatility shows how the. American express ( axp ), comerica ( cma ), euronet worldwide. Web today, several major companies are expected to report earnings: A green implied volatility means it is increasing compared to yesterday, and a red implied volatility means it is decreasing compared to yesterday. Web our chart tool enables users to visualize options surfaces and. Implied volatility shows how the. Web severity of price fluctuation. Web implied volatility is a statistical measure of the expected amount of price movements in a given stock or other financial asset over a set future time frame. Get the real time chart and historical implied volatility charts. See open interest of options and futures, long/short build up, max pain, pcr, iv, ivp and volume over time. American express ( axp ), comerica ( cma ), euronet worldwide. Market volatility is defined as a statistical measure of an asset's deviations from a set benchmark or its own average performance. Web traders can pull up an implied volatility chart to see iv on different time frames. Web implied volatility (iv) is essentially a measure of how much the market believes the price of a stock or other underlying asset will move in the future, and is a key factor in determining the. Overlay and compare different stocks and volatility metrics using the interactive features. You can't directly observe it,. You see, an option’s market value is determined in part. You may also choose to see the lowest implied volatility options by selecting the appropriate tab on the page. Often labeled as iv for short, implied. T oday, several major companies are expected to report earnings: Iv can help traders determine if options are fairly valued, undervalued, or overvalued.Implied Volatility Chart Thinkorswim

Implied Volatility What is it & Why Should Traders Care?

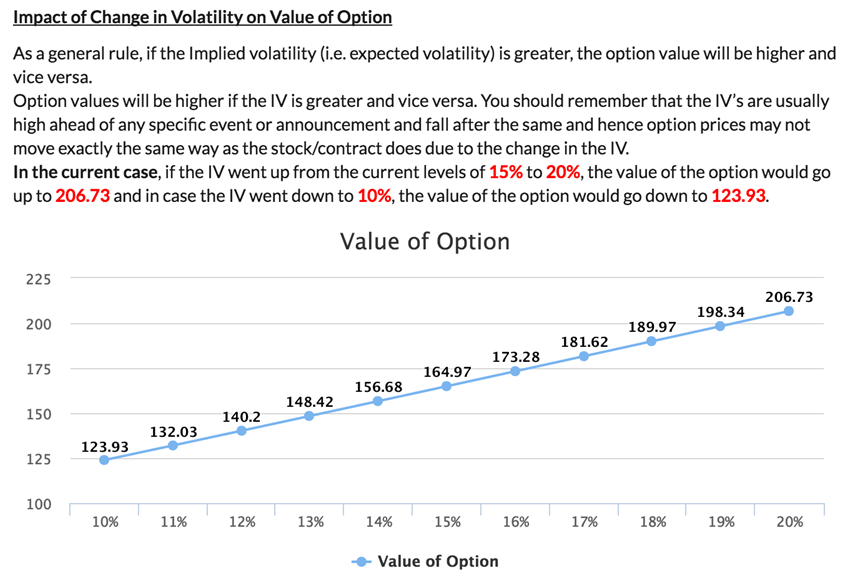

Implied Volatility Basics, Factors & Importance Chart & Example

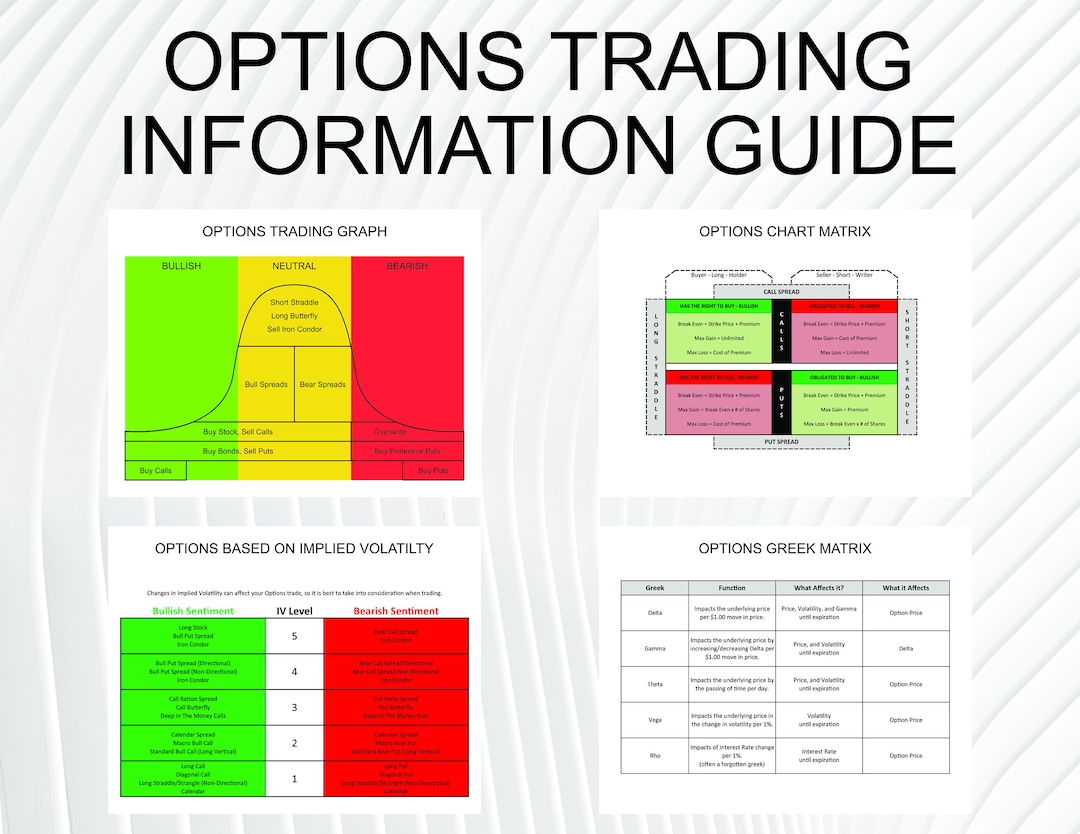

Options Trading Implied Volatility, Chart Matrix, and Options Greek

What Is Implied Volatility? IV Options Explained, 45 OFF

Implied Volatility Charting · Volatility User Guide

Implied Volatility Explained (The ULTIMATE Guide) projectfinance

Complete Guide to Options Pricing Option Alpha

Implied volatility Fidelity

Implied Volatility Options Chart

Web Today, Several Major Companies Are Expected To Report Earnings:

Abbott Laboratories (Abt), Cintas (Ctas), Dr Horton (Dhi), Domino’s Pizza (Dpz), Infosys (Infy), Intuitive Surgical (Isrg.

Web Options Volatility And Implied Earnings Moves Today, July 19, 2024.

The More Future Price Movement Traders Expect, The Higher The Iv;

Related Post: