Triple Top Chart Pattern

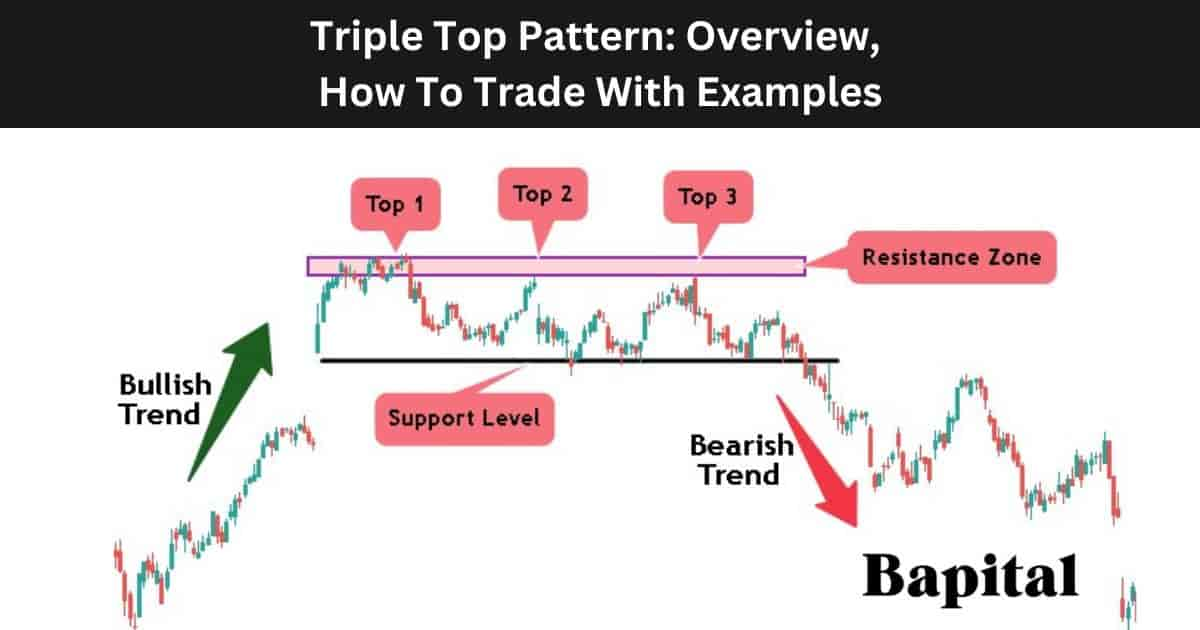

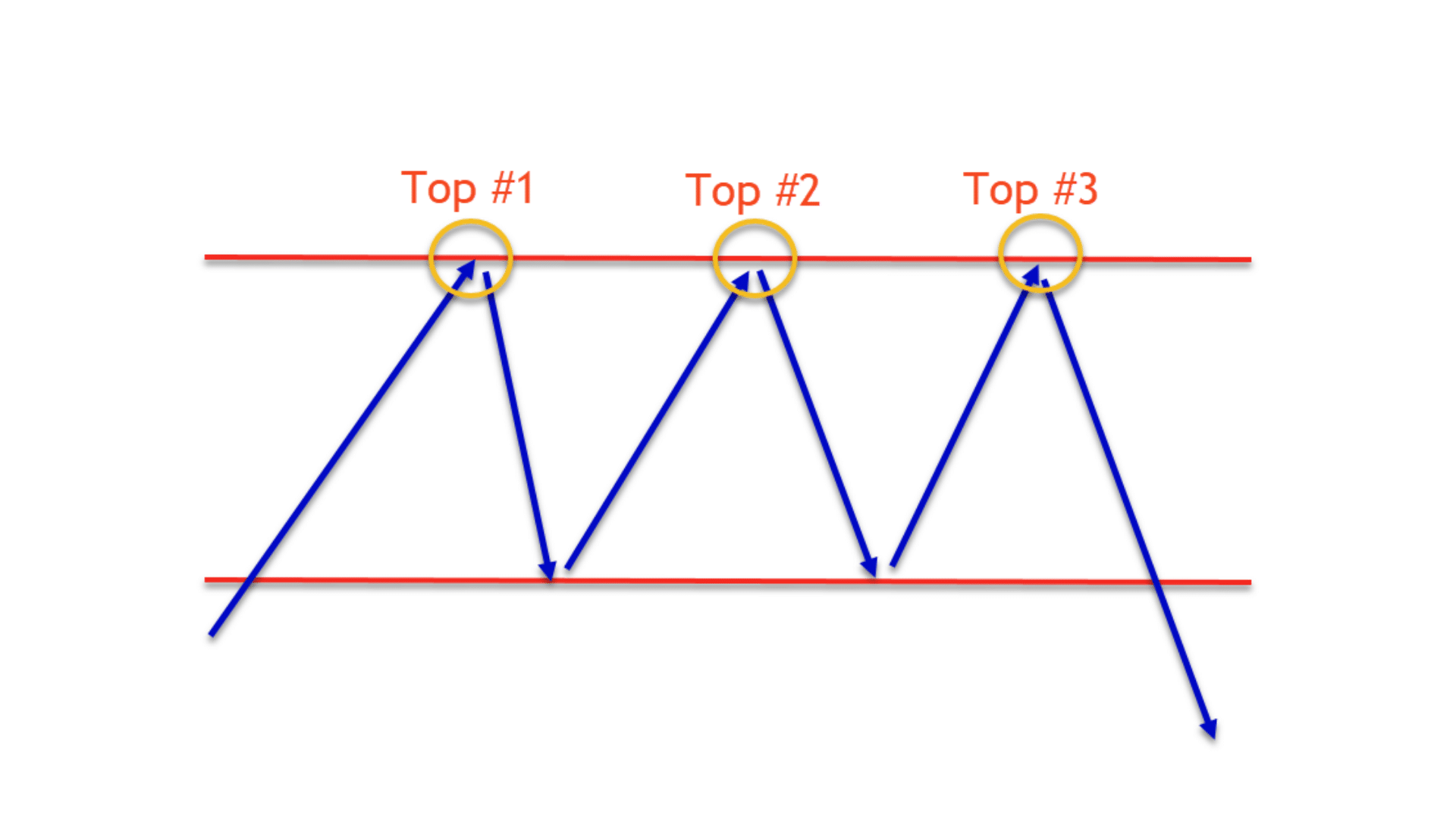

Triple Top Chart Pattern - Web a triple top is a technical chart pattern that signals an asset is no longer rallying, and that lower prices are on the way. Mastering this pattern can significantly improve your trading decisions and help you anticipate. Web a triple top is a bearish reversal chart pattern that signals that buyers are losing control to the sellers. In this complete guide to the triple top pattern, you’ll learn the common interpretation of the pattern, as well as how you may go about to improve its performance. This bearish reversal pattern occurs when an asset’s price reaches a resistance level three times before eventually declining. Web the triple top pattern is a crucial chart pattern in technical analysis that helps traders predict price reversals in financial markets. Web a triple top is formed by three peaks moving into the same area, with pullbacks in between, while a triple bottom consists of three troughs with rallies in the middle. Thus, it’s commonly interpreted as a sign of a coming bearish trend. Web the triple top chart pattern is a key formation in technical analysis, known for signaling potential reversals in bullish trends. Buyers are in control as the price makes a higher high, followed by a pullback. Web a triple top is a bearish reversal chart pattern that signals that buyers are losing control to the sellers. Next, the first peak level is formed, the price decreases quickly or gradually. Here’s how it looks like… let me explain… #1: This bearish reversal pattern occurs when an asset’s price reaches a resistance level three times before eventually declining. Web the triple top chart pattern is a key formation in technical analysis, known for signaling potential reversals in bullish trends. Web a triple top is a bearish reversal chart pattern that signals the sellers are in control (the opposite is called a triple bottom pattern). Buyers are in control as the price makes a higher high, followed by a pullback. It consists of three peaks or resistance levels. Web a triple top is a technical chart pattern that signals an asset is no longer rallying, and that lower prices are on the way. Web the triple top pattern is a crucial chart pattern in technical analysis that helps traders predict price reversals in financial markets. Here’s how it looks like… let me explain… #1: In this complete guide to the triple top pattern, you’ll learn the common interpretation of the pattern, as well as how you may go about to improve its performance. Web a triple top is a technical chart pattern that signals an asset is no longer rallying, and that lower prices are. This bearish reversal pattern occurs when an asset’s price reaches a resistance level three times before eventually declining. Next, the first peak level is formed, the price decreases quickly or gradually. In this complete guide to the triple top pattern, you’ll learn the common interpretation of the pattern, as well as how you may go about to improve its performance.. Web a triple top is a bearish reversal chart pattern that signals that buyers are losing control to the sellers. Web the triple top chart pattern is a key formation in technical analysis, known for signaling potential reversals in bullish trends. Mastering this pattern can significantly improve your trading decisions and help you anticipate. Thus, it’s commonly interpreted as a. It consists of three peaks or resistance levels. Mastering this pattern can significantly improve your trading decisions and help you anticipate. Next, the first peak level is formed, the price decreases quickly or gradually. Web a triple top is formed by three peaks moving into the same area, with pullbacks in between, while a triple bottom consists of three troughs. In this complete guide to the triple top pattern, you’ll learn the common interpretation of the pattern, as well as how you may go about to improve its performance. Here’s how it looks like… let me explain… #1: It consists of three peaks or resistance levels. Web a triple top is a bearish reversal chart pattern that signals that buyers. Web a triple top is a bearish reversal chart pattern that signals that buyers are losing control to the sellers. Web a triple top is formed by three peaks moving into the same area, with pullbacks in between, while a triple bottom consists of three troughs with rallies in the middle. Thus, it’s commonly interpreted as a sign of a. Web the triple top chart pattern is a key formation in technical analysis, known for signaling potential reversals in bullish trends. Thus, it’s commonly interpreted as a sign of a coming bearish trend. Web a triple top is formed by three peaks moving into the same area, with pullbacks in between, while a triple bottom consists of three troughs with. In this complete guide to the triple top pattern, you’ll learn the common interpretation of the pattern, as well as how you may go about to improve its performance. Here’s how it looks like… let me explain… #1: Next, the first peak level is formed, the price decreases quickly or gradually. Buyers are in control as the price makes a. In this complete guide to the triple top pattern, you’ll learn the common interpretation of the pattern, as well as how you may go about to improve its performance. Mastering this pattern can significantly improve your trading decisions and help you anticipate. Buyers are in control as the price makes a higher high, followed by a pullback. Web the triple. Buyers are in control as the price makes a higher high, followed by a pullback. Web a triple top pattern is a bearish pattern. Next, the first peak level is formed, the price decreases quickly or gradually. Web a triple top is a bearish reversal chart pattern that signals the sellers are in control (the opposite is called a triple. Next, the first peak level is formed, the price decreases quickly or gradually. This bearish reversal pattern occurs when an asset’s price reaches a resistance level three times before eventually declining. Web the triple top pattern is a crucial chart pattern in technical analysis that helps traders predict price reversals in financial markets. Here’s how it looks like… let me explain… #1: Web a triple top pattern is a bearish pattern. Web a triple top is a bearish reversal chart pattern that signals that buyers are losing control to the sellers. Thus, it’s commonly interpreted as a sign of a coming bearish trend. Web the triple top chart pattern is a key formation in technical analysis, known for signaling potential reversals in bullish trends. Web a triple top is formed by three peaks moving into the same area, with pullbacks in between, while a triple bottom consists of three troughs with rallies in the middle. Mastering this pattern can significantly improve your trading decisions and help you anticipate. It consists of three peaks or resistance levels. In this complete guide to the triple top pattern, you’ll learn the common interpretation of the pattern, as well as how you may go about to improve its performance.Triple Top What It Is, How It Works, and Examples

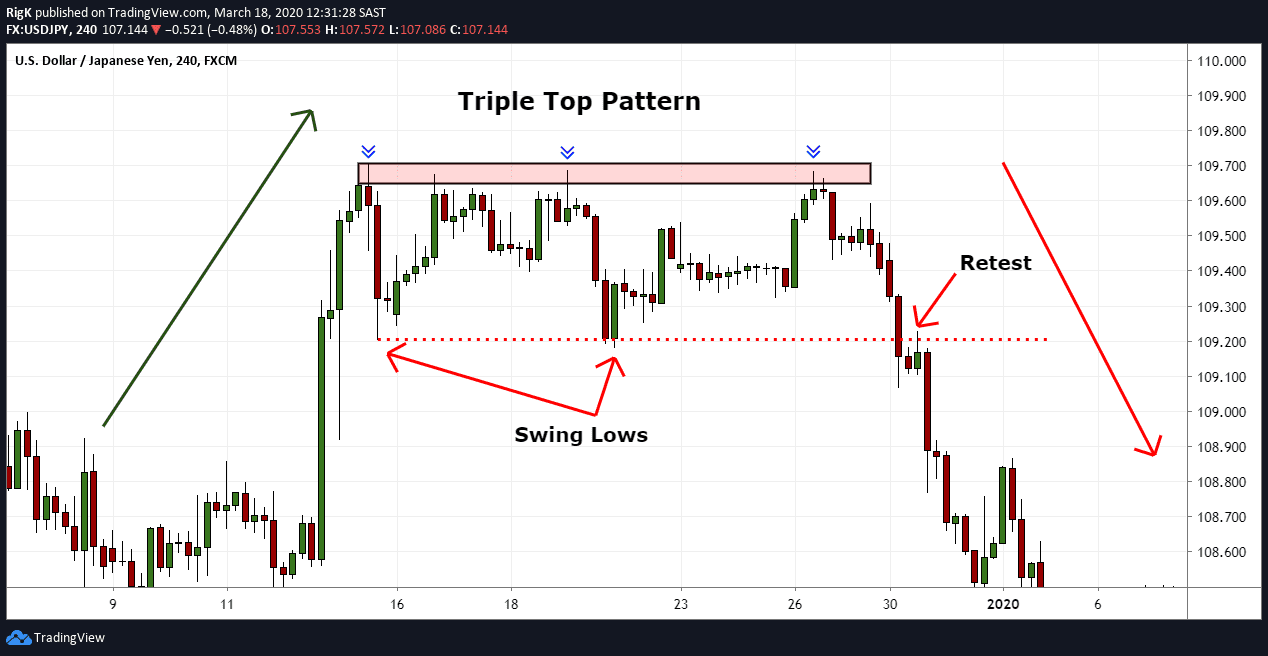

How to trade Triple Top chart pattern EASY TRADES

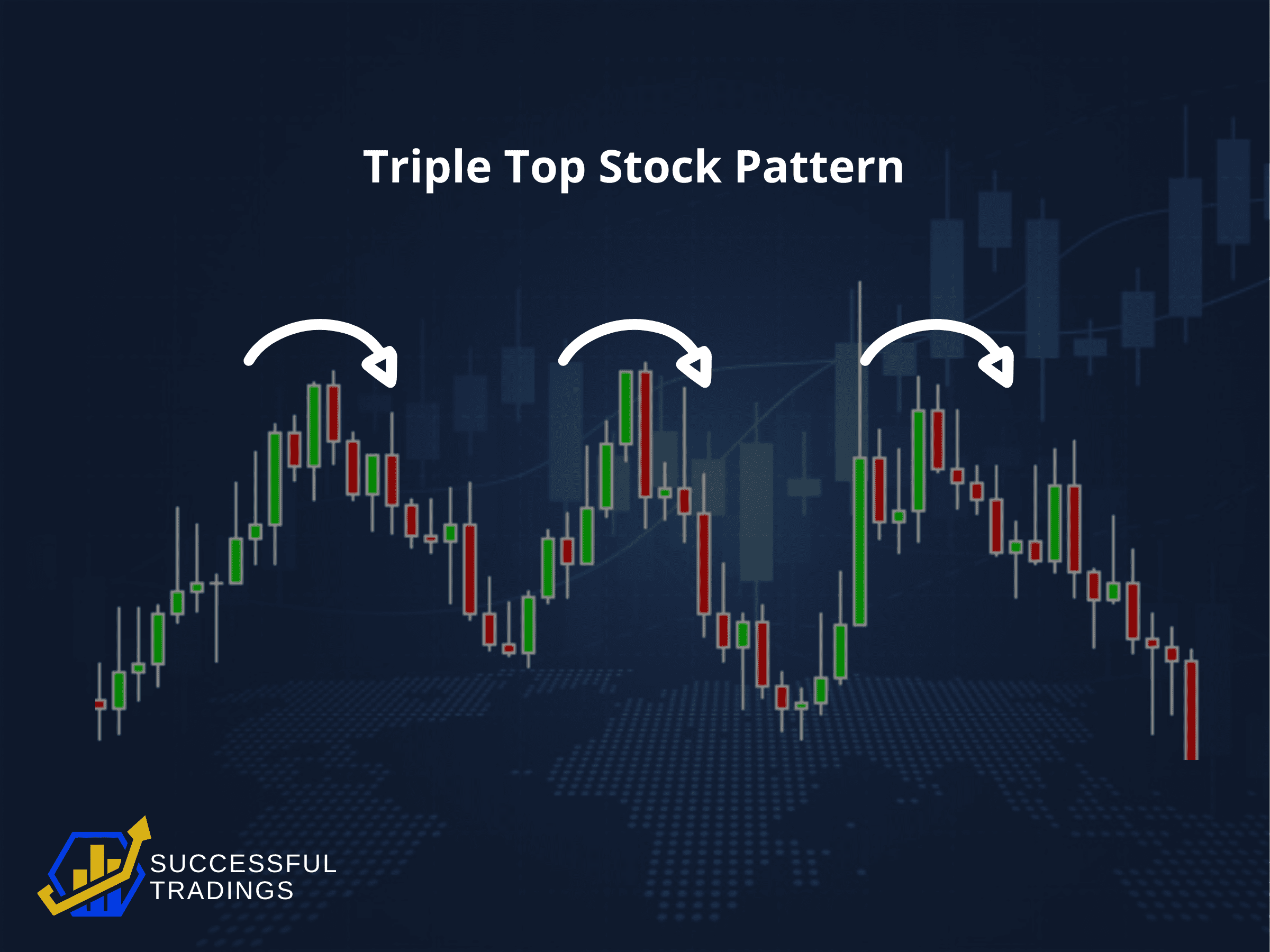

Triple Top Stock Pattern Explained In Simple Terms

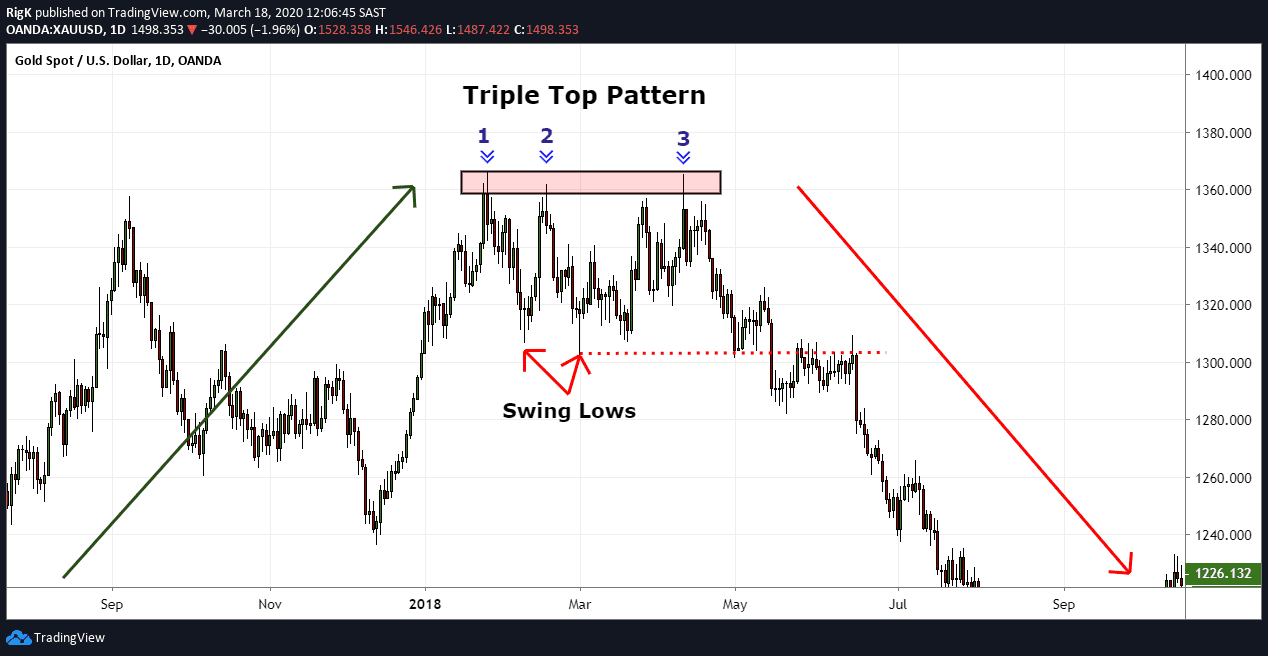

Triple Top Pattern A Guide by Experienced Traders

The Complete Guide to Triple Top Chart Pattern

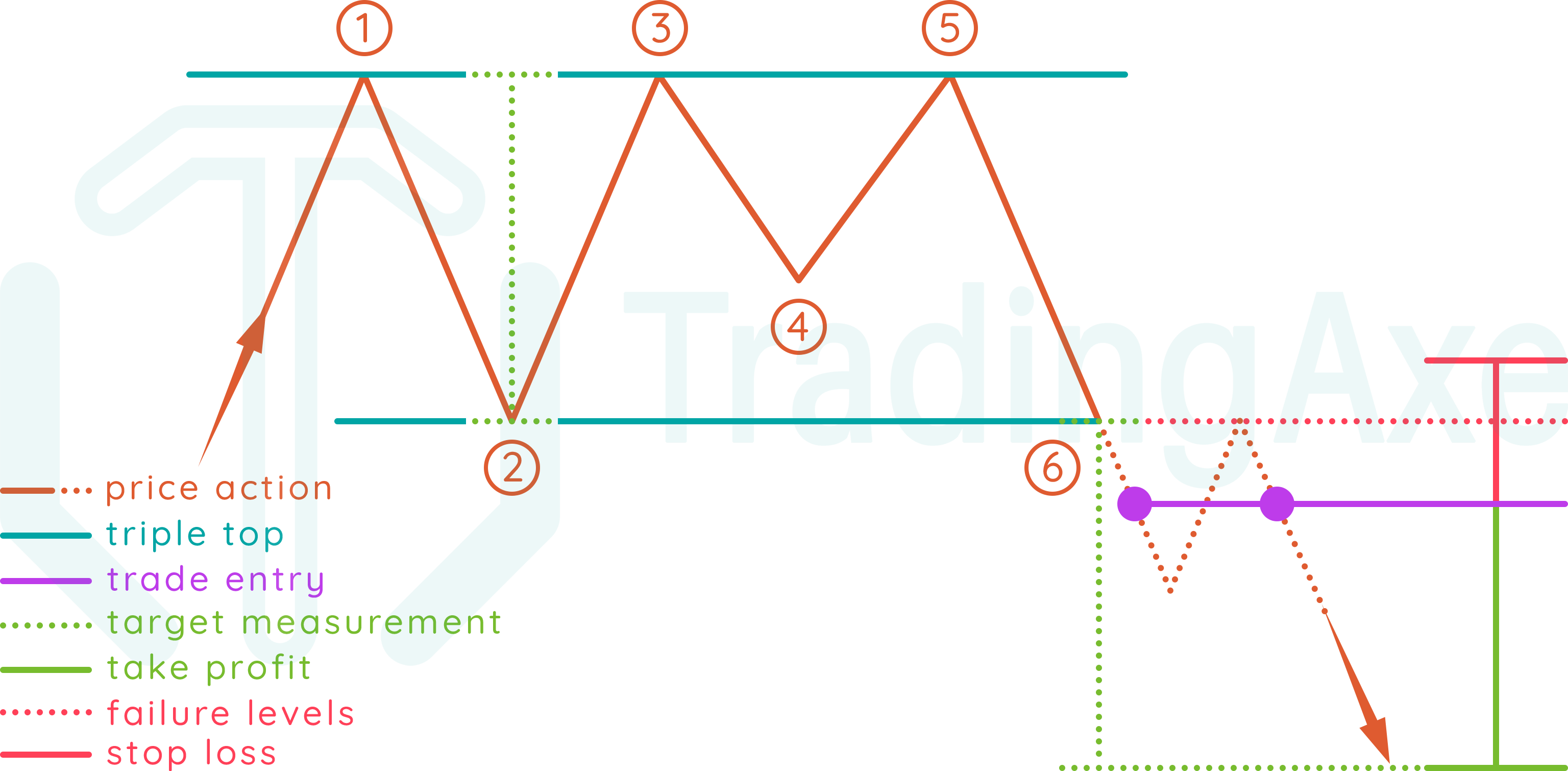

How To Trade Triple Top Chart Pattern TradingAxe

Triple Top Pattern A Guide by Experienced Traders

Triple Top Chart Pattern Trading Strategy

Triple Top Pattern Overview, How To Trade With Examples

How to Find and Trade the Triple Top Pattern

Web A Triple Top Is A Bearish Reversal Chart Pattern That Signals The Sellers Are In Control (The Opposite Is Called A Triple Bottom Pattern).

Buyers Are In Control As The Price Makes A Higher High, Followed By A Pullback.

Web A Triple Top Is A Technical Chart Pattern That Signals An Asset Is No Longer Rallying, And That Lower Prices Are On The Way.

Related Post:

:max_bytes(150000):strip_icc()/dotdash_Final_Triple_Top_Dec_2020-01-78a37beca8574d169c2cccd1fc18279d.jpg)